Unlocking Lifelong Security: A Deep Dive into How Life Insurance Works

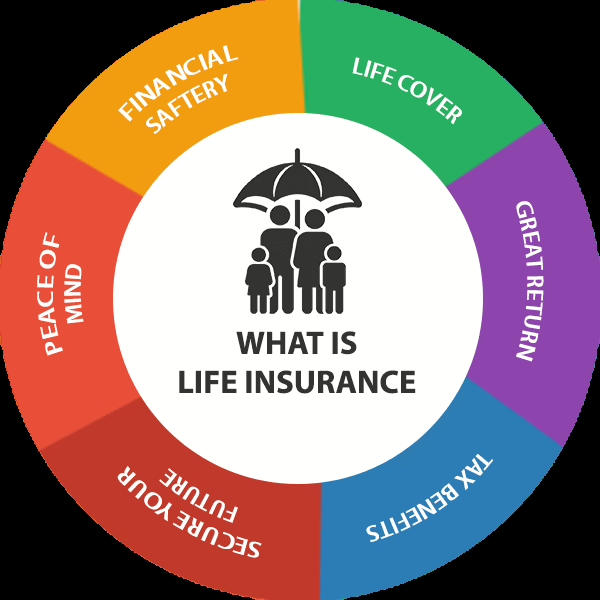

In the intricate tapestry of financial planning, life insurance stands as a vital thread, weaving a safety net for your loved ones in the face of life’s inevitable uncertainties. While the fundamental concept of how life insurance works might seem straightforward, a deeper exploration reveals a nuanced mechanism designed to provide enduring financial security. Let’s embark on a comprehensive journey to unravel the intricacies of life insurance and understand its profound impact.

At its essence, how life insurance works hinges on a contractual agreement between you, the policyholder, and an insurance provider. This agreement stipulates that in exchange for your consistent premium payments, the insurance company pledges to disburse a predetermined sum, known as the death benefit, to your designated beneficiaries upon your passing. This financial provision acts as a crucial pillar of support for your family, offering a buffer against potential financial hardships, enabling them to navigate expenses, maintain their accustomed lifestyle, and pursue long-term financial goals without undue burden.

The Orchestra of Roles: Key Players in Your Life Insurance Policy

To truly grasp how life insurance works, it’s imperative to recognize the distinct roles played by each party involved in the policy:

- The Policyholder: The Conductor of Your Coverage: This is the individual who assumes ownership of the life insurance policy and bears the responsibility for ensuring timely premium payments. The policyholder also wields the authority to make crucial decisions regarding the policy, such as updating beneficiary designations, modifying coverage amounts (within certain limitations), and potentially accessing the policy’s cash value components in permanent life insurance.

- The Insured: The Life Under Protection: This is the individual whose life is covered by the life insurance policy. Often, the policyholder and the insured are the same person. However, circumstances may arise where one individual secures a policy on the life of another, such as a parent insuring a child’s future or a business safeguarding against the loss of a key executive.

- The Beneficiary: The Recipient of Security: This is the individual, individuals, or entity designated by the policyholder to receive the stipulated death benefit upon the insured’s passing. Policyholders retain the flexibility to name multiple beneficiaries and specify the precise percentage of the death benefit each will receive, ensuring tailored distribution according to their wishes.

- The Insurance Company: The Guardian of the Promise: This is the financial institution that underwrites the life insurance policy, meticulously assessing risk and ultimately committing to pay the agreed-upon death benefit, provided that premiums are consistently paid and the policy terms are diligently adhered to. The insurance company acts as the guarantor of the financial security promised by the policy.

The Interplay of Finance: Premiums and the Death Benefit Unveiled

The fundamental mechanics of how life insurance works are elegantly intertwined through the exchange of premiums for the assurance of a death benefit:

- Premiums: The Investment in Security: These are the periodic payments you make to maintain the active status of your life insurance policy. The calculation of your premium is a nuanced process, influenced by a confluence of factors including your age (generally, younger individuals benefit from lower premiums), your health status (healthier individuals typically qualify for more favorable rates), your lifestyle choices (factors like smoking can significantly impact premiums), the specific type of policy you select, and the magnitude of the coverage you seek (the death benefit amount). Understanding the factors influencing premiums is crucial to appreciating the cost-benefit analysis of how life insurance works for your unique circumstances.

- Death Benefit: The Promise Fulfilled: This represents the predetermined lump-sum payment that your designated beneficiaries receive upon your passing. The crucial decision of determining the appropriate death benefit amount should be a thoughtful process, carefully considering your family’s current and future financial needs. This includes accounting for outstanding debts (such as mortgages or loans), ongoing living expenses, potential future educational costs for children, and any other financial obligations you wish to ensure are covered. A well-calculated death benefit ensures that how life insurance works effectively translates into meaningful financial support for your loved ones.

A Spectrum of Choices: Exploring Diverse Life Insurance Policy Types

The landscape of life insurance offers a variety of policy types, each with its own distinct features and benefits, influencing how life insurance works in practice. The two primary categories are term life insurance and permanent life insurance:

- Term Life Insurance: Coverage for a Defined Horizon: This type of policy provides coverage for a specific duration, or “term,” which can range from several years (e.g., 10 years) to several decades (e.g., 30 years). Term life insurance is generally characterized by its relative affordability, particularly in the earlier years, as it solely provides coverage for a predetermined period. If the insured passes away within the specified term, the death benefit is paid to the beneficiaries. However, if the term expires while the insured is still living, the coverage ceases unless the policyholder opts to renew the existing policy (often at a higher premium due to increased age) or purchase a new policy.

Comprehending the time-bound nature of coverage is fundamental to understanding how term life insurance works and its suitability for specific financial goals, such as covering a mortgage or children’s education during their dependent years. - Permanent Life Insurance: Lifelong Protection and Potential Growth: In contrast to term life, permanent life insurance offers coverage that extends throughout the insured’s lifetime, provided that premiums are consistently paid. A distinguishing feature of many permanent life insurance policies is the accumulation of cash value over time on a tax-deferred basis. This cash value component can grow based on the specific type of permanent policy.

Policyholders may have the option to access this cash value through loans or withdrawals, although it’s crucial to understand that doing so will typically reduce the policy’s death benefit and may have tax implications. Common types of permanent life insurance include whole life (offering a fixed death benefit and cash value growth), universal life (providing more flexibility in premium payments and death benefit options), and variable life (allowing policyholders to allocate the cash value to various investment options, with the potential for higher growth but also greater risk).

A thorough understanding of the cash value accumulation and access features is essential to fully appreciate the long-term financial implications of how permanent life insurance works as a wealth-building and estate planning tool.

The Indispensable Value: Why Understanding Life Insurance is Paramount

A comprehensive understanding of how life insurance works is not merely academic; it’s a cornerstone of responsible financial planning, empowering you to make informed decisions that safeguard your family’s future:

- Strategic Coverage Planning: By grasping the intricacies of how the death benefit functions, you can accurately assess your family’s financial needs and select a policy that provides adequate financial security to address potential future expenses and maintain their quality of life.

- Policy Selection Alignment: Recognizing the fundamental differences between term and permanent life insurance enables you to choose the policy type that best aligns with your individual financial objectives, time horizon, and risk tolerance.

- Informed Financial Management: For permanent life insurance policies with a cash value component, understanding how this value accumulates and can be accessed allows for more strategic financial planning and utilization of this asset.

- Unwavering Peace of Mind: The knowledge that you have proactively established a plan to protect your loved ones from potential financial hardship in your absence provides invaluable peace of mind, allowing you to focus on the present with greater security.

Navigating the Path: Securing Your Life Insurance Coverage

While the underlying principles of how life insurance works involve a contractual agreement, the process of obtaining a policy typically involves the following key steps:

- Needs Assessment: Begin by thoroughly evaluating your family’s current and future financial obligations to determine the appropriate amount of life insurance coverage required.

- Research and Comparison: Explore various insurance companies and the diverse range of policy options they offer. Obtain and compare quotes from multiple providers to assess premiums and coverage details.

- Application Process: Complete a detailed application, providing accurate information about your health history, lifestyle, and designated beneficiaries.

- Underwriting Evaluation: The insurance company will undertake an underwriting process to assess your risk profile, which will influence your premium rates and the decision to issue a policy. This may involve a medical examination and review of your medical records.

- Policy Issuance and Review: Upon approval, you will receive your comprehensive policy documents outlining all the terms and conditions of your life insurance coverage. It’s crucial to carefully review these documents to ensure accuracy and understanding.

- Consistent Premium Payments: Maintain your coverage by making regular and timely premium payments as stipulated in your policy agreement.

In conclusion, by delving into the intricacies of how life insurance works, you equip yourself with the knowledge to make sound financial decisions that protect your loved ones and secure their future. Life insurance is more than just a policy; it’s a testament to your care and a legacy of financial security.

Searched: Burial insurance, critical illness insurance, guaranteed issue life insurance, no medical exam life insurance, final expense insurance, whole life insurance for seniors, best life insurance for diabetics, affordable life insurance for families, term life insurance with living benefits, life insurance for self-employed individuals